Click on The Appropriate Section

Click on The Appropriate Section

NOVEMBER 25th 2009

IS A LANDMARK DAY IN BANKING HISTORY. FOR

THE BANKS HAVE BASICALLY WON

A BATTLE BUT IN THE PROCESS HAVE LOST THE

WAR

Yes the OFT

have lost their case

against the Banks on a technicality but in

the 46 page summing up the

Supreme Court made it clear that the

underlying reasons of the OFT

claim were right and that the banks have

not just been overcharging but

by their own devious actions have been

creating unauthorised overdrafts

so as to then take massive

disproportionate charges. This we realised

some time ago especially where the banks

have tried to take a charge of

up to £8 a day on overdrafts of a few

pence. Their little game is

to allow an unauthorised overdraft of a

few £'s so that they can

claim their large daily rate and then

bounce any further payments. The

question is why did they allow the

original unauthorised overdraft in

the first place. In most cases the

customer didn't request the

overdraft- therefore the debt is the fault

of the bank and the Customer

should NOT pay such charges.

To the OFT, the Supreme Court hinted that

it might want to look at a

different section of the law. Instead of

regulation six, it should look

to regulation five. By not allowing the

customers to have a say in

whether the bank should accept

transactions that take them beyond their

unauthorised overdraft limit, for example,

the banks could be said to

be in breach of this regulation. Therefore

we shall take every case we

are dealing with to the Courts under

section 5, as we have been doing

for some years now.

We

specialize in challenging Banks

& Credit Card Companies in regards their

charges on credit cards

and charges for

bouncing cheques and

Direct Debits. We also act

for people who are being persued for debts &

advise them how to

defend

against those debts and the charges that are

being included in

them.

In most cases these charges are

disproportionately high and it is

likely

that these Companies are conducting unfair terms

under CONSUMER

CONTRACT

REGULATIONS

1999 . Further in many cases they

have been taking

insurance

premiums to cover debts if the creditor loses

his/her job, but still

chase

the creditor when they may have collected an

insurance payout.

We name & shame these

financial institutions who are ripping

off

their customers and direct clients to the

appropriate authorities to

report

them to. In recent months these actions have

gathered pace & the

banks

are trying more unfair methods of fighting back

like closing accounts.

We

can assist you by further naming & shaming

the individuals in the

banks

playing such games. Remember they only got big

by servicing the public

&

if they abuse the public then they can also meet

the same people on the

way

down. We have had questions asked in Parliament

and will continue to

fight

for the Consumer. We have now added a list of

the leading CEOs in the

UK for

YOU to contact direct so avoiding call centres

etc

BANK

& CREDIT CARD CHARGES

|

It

really

annoys us when banks and other

financial firms penalise

customers so heavily for their

mistakes. However, when the boot’s

on

the other foot, these companies

are quick to deny responsibility

and

routinely refuse to pay out

compensation when they mess

up.Therefore,

if you’ve got a grievance, then

don’t get mad, get even. Here are

five

ways to fight back against

bullying banks:

1.

Recover unauthorised overdraft

charges

If

you go

overdrawn without permission,

exceed your overdraft limit, or

‘bounce’

payments from your current

account,

then your bank will punish you for

your mistake. You can expect to

pay

up to £40 per slip-up, even if

your unauthorised borrowing is

just a

few pounds. However,

the

Office of Fair Trading (OFT)

believes that

these punitive charges are unfair,

so it has taken legal action

against

eight banks and building

societies.This case is being heard

now.

However

the

Staute of Limitations Act 1980

in English law means

that you can go back six years

when attempting to reclaim these

charges. So, if you’ve been fined

for unauthorised borrowing at any

point since late July 2002, submit

a claim now in writing. Then, when

the OFT finally wins its case,

you’ll already be in the queue for

compensation.

2.

Claim back credit-card fines

Credit

card

providers

make billions of pounds

every year from people just

like you. They

attach excessive charges at

every available opportunity

and it's not

fair. They

could owe you thousands.

Until two years ago,

most credit-card issuers would

charge fines of £20 to £30

for bounced,

late or missed payments, or for

exceeding your credit limit.

However,

in April 2006, the OFT decided

that these penalty charges were

unfair.

In response to this ruling, card

issuers reduced their charges to

no

more than £12 a time.

Again, if

you’ve been fined by your

credit-card company at any point

in the past six years, then apply

for

a refund. Don’t be fobbed off with

excuses, as many card issuers falsely

claim that these refunds are, like

bank-charge claims, on hold for

the

duration of the above court case.

Also, demand full repayment of

each

fine -- don’t allow your card

issuer to pay only the difference

between

your fine and the ‘fair’ (!) fee

of £12.

|

3. Recoup

mortgage exit arrangement fees

Mortgage

lenders

have also been guilty of

charging massive "exit" fees

on

mortgages. If

you have been charged a mortgage

exit

arrangement fee greater than

that stipulated in your

contract, then

demand a refund from your

mortgage lender. This massive

‘fee

inflation’ is unfair and, in

January 2007, the Financial

Services

Authority (FSA) agreed.

4. Demand

mis-selling compensation

Over the

years we have witnessed massive

mis-selling in the Financial

Services

Industry. Our battles date back to

the 1960's and 1970's when the

large

insurance companies went to war

with us for giving our client's

discounts on financial purchases.

To-day the authorities recommend

it. We can recall

regulatory failures, mis-selling

problems, FSA fines and

compensation

payouts to the public regarding

(in alphabetical order):

- business bank accounts;

- Equitable Life;

- extended warranties;

- free-standing additional

voluntary

contributions (extra pensions);

- guaranteed equity bonds;

- hamper firm Farepak;

- high-income ‘precipice’

bonds;

- home-income plans

(investment mortgages

in the Eighties and Nineties);

- Nation Life (The William

Stern Scandal)

- maximum investment plans;

- mortgage endowments;

- payment protection

insurance;

- personal pensions;

- secured loans (second

mortgages);

- split-capital investment

trusts; and

- store cards.

- Theft of Pension

Dividends in 1997 by

Gordon Brown in breach of

pension contracts.

There

are seventeen scandals in the above

list, but perhaps the most

significant is the widespread

mis-selling of mortgage endowment

policies. Indeed, the possible

shortfall from these failing

part-insurance/part-investment

policies could exceed £50 billion.

This happened because the "terminal

bonus", which had formerly been

given was disapated by companies

purchasing "second hand

policies". |

In

the early nineties we witnessed an

arguement between the principals

of

Insurance Companies & the 2nd

hand purchasers. Those Principals

are

criminally guilty of allowing past

performance to be shown when THEY

KNEW the figures could not be

reproduced.

5. Don’t

forget to charge for your time

Remember

that

you should always insist

that you also be compensated for

inconvenience, distress and time

wasted. So, if your bank charges

you for a computer-generated

letter, return the favour by

charging for the above. If

you are taking time off your work

to

spend hours listening to music on

the telephone charge them at an

hourly rate!

6 What

Should You Do Now?

If

you have already made a

complaint - it is

likely that your

claim for bank charge refund

will be frozen pending the

outcome of the

test case. If an offer

has been made and you have

accepted that

offer, the bank would be

bound to honour the

agreement under the normal

rules of contract.

If

you have already taken

Court Action -

there likely to

be a direction from the

Courts that all actions will

also be

frozen. This is usual

in test cases as this will

save court time,

costs, duplication of work

and a prevention of

conflicting court

judgements. Cases will

then be reviewed once a

final decision

from the test cases are

handed down.

If

you

have not made a complaint

to date - it is

our advice that you

should contact

us and make a formal claim

now. If the test

claims win at court,

as

you have registered your

claim, it will help speed up

the claim

process. In simple

terms you are more likely to

be paid out

earlier. We cannot

make any guarantees but in

our experience in

test cases this often

happens. Groups of

claimants who have been

waiting longer for the test

case to conclude

would normally be those who

are paid out first.

We would imagine

that

if the test case is

successful there would be a

mass of people putting

in claims which would result

in severe delays.

You

should register with us now

by

contacting

us on 0870 794 2180 or

Contact

us

by clicking here and

we will contest the charges.

(UK Only)

|

Update

February 26th 2009

Eight

banks have lost an appeal

aimed

at stopping the investigation

into overdraft charges, so the legal

battle goes on.

We

have cheery news for fed-up banking

customers: the banks have lost

their latest attempt to halt the Office of

Fair Trading (OFT)

investigation into unfair overdraft fees

charged by current

accounts.

The

OFT wins round one

Eight

banks -- Barclays, Clydesdale, HBOS, HSBC,

Lloyds TSB, RBS and

Nationwide BS -- argued that the OFT did not

have the authority to

investigate whether their charges for

unauthorised overdrafts were

unfair and, therefore, unenforceable. The

Court of Appeal disagreed and

backed the OFT.

THE

LEGAL POSITION AS OF OCTOBER 2008

For

some time now there have been a series of

hearings as the Office of

Fair Trading has been challenging the

Banks on their charges. The

current position for you in four simple

bullet points:

- The

High Court has ruled that the OFT can

assess whether charges are unfair

and take action against the banks, but

the banks have appealed this

decision and we await the appeal

hearing. Whether the OFT chooses to

take action against the banks remains to

be seen.

- The banks

have almost totally closed one of the

arguments - that the charges are

unlawful penalties under common law. The

charges could still be

unlawful penalties under totally

different law: the UTCCR.

- The FSA waiver

remains in place, meaning people can’t

at the moment reclaim charges

but the banks can continue to charge

them. Wealthier people continue to

pay nothing for their current accounts.

- Only when all this is

over will we know whether we can reclaim

charges, and whether the banks

will continue to charge us or scrap free

banking.

-

Avoid

this devious credit card sting!

Donna

Werbner Published

in

Credit

cards

on 16

March 2009

-

|

Using

this

little-known trick,

companies can take automatic

payments

from your credit card - even

after you've closed it down!

Imagine this. You pay

off your credit

card,

close down the account and

cut up the card. All is

settled until months

later, out of the blue, you

get a statement from the

credit card

provider, demanding payment

for a new transaction on the

card. It's for

a 'recurring payment' - and

it's one of the slimiest

credit card stings

ever hidden in the small

print.

How recurring

payments work

On the surface, a

recurring payment

works in exactly the same

way as

a direct debit. You

authorise a company to take

regular payments - say,

for an annual subscription

or service - from your

credit card. Simple,

easy, convenient... until

you want to cancel it.

Unlike a direct debit,

a recurring

payment does not

automatically

cease to exist when you

close your account down. You

cannot even cancel

it by notifying your credit

card provider that you want

it to stop. The

only way to cancel a

recurring payment is to ask

the original merchant

you set it up with to stop

taking the payments.

A dangerous

system

As if that wasn't

enough, there are two

big dangers associated with

this method of payment:

You and you alone are

responsible for

keeping a record of all the

recurring payments you have

set up on your card. The

credit card

provider will not keep track

of them. And if you don't know

which

companies are authorised to

take recurring payments from

your card,

then you will not be able to

cancel the payments.

If you cancel the account and

then, say, move house, your

statement

will go to your old address.

So you will have no way of

knowing that a

new payment has been taken

from your card, and that you

need to pay it

off. |

This

could lead to a black mark

being

placed on your credit

record, which could cause

you serious

problems if you try

to take out a new card or

borrow a mortgage

in the future.

So

if you're

ever faced with the option

of making a regular payment

by credit card or direct

debit, my advice would be to

choose the direct

debit route every time.

Too

late

If

this

advice comes a little too

late for you - - then

what can you do

about it?

Neil

wrote

in to lovemoney.com because,

six months after cancelling

an MBNA credit card, he

received a statement stating

that more than

£90

had been paid from the card

to a car breakdown company.

This was for

cover he no longer needed or

wanted.

What

to

do

What

should

you do if you find yourself

in this situation?

1.

Dispute

the payment with the

company that took it.

Believe

it

or not, you are much more

likely to get a refund this

way

than arguing with the credit

card company that you closed

the account

or weren't aware that the

payment would recur. Here's

how to argue your

case:

- A reputable company

will send you a

letter warning you that

your

subscription is up for

renewal, and that payment

will be taken on a

particular date. If you

didn't receive this

letter, you have a case

for

disputing the payment.

|

Depending

on

what you have bought, you

should have a cooling off

period of at least seven days,

where you can cancel the

policy or

return the goods. Contact Consumer

Direct

to double-check your rights,

if you find this cooling off

period is

disputed. You may even have

longer than seven days.

Finally,

try

explaining your situation

calmly and reasonably. For

example, Neil, our 66-year-old

reader, no longer drives a car

and

therefore has no need for car

breakdown cover. Clearly, he

would not

have renewed this cover

voluntarily. Most reputable

companies will take

a reasonable attitude when

there is a clear case for a

refund like

this. If they don't, you could

try reporting them to a

relevant

regulator or trade body.

2.

Dispute

the payment with the credit

card provider.

If

you fail

to get a refund from the

company that took the

payment,

it's still worth at least

trying to get a refund from

the credit card

provider - although it may

be difficult.

If you have

cancelled your card, you could

argue that you hadn't

realised that the payment

would be taken. This is

especially true if it

is obvious, as in Neil's case,

that you would never have

knowingly

renewed the subscription or

service.

Alternatively,

do

bear in mind you have Section

75

Protection

for payments over £100. So if

the product cost more than

£100 and was

misrepresented to you in any

way, you could dispute the

payment on

these grounds.

Using

these

arguments, I am pleased to

say Neil successfully

managed

to get his payment refunded

- but only after Citizens

Advice got

involved.

Many

of you

with recurring payments on

your cards may not be so

lucky. So watch out

for this nasty little credit

card

sting - and stick to direct

debits whenever you can!

|

Using this

little-known

trick, companies can take automatic

payments

from your credit card - even after

you've closed it down!

Imagine this. You pay off your credit card,

close down the account and cut up the

card. All is settled until months

later, out of the blue, you get a

statement from the credit card

provider, demanding payment for a new

transaction on the card. It's for

a 'recurring payment' - and it's one of

the slimiest credit card stings

ever hidden in the small print.

How recurring payments work

On the surface, a recurring payment

works in exactly

the same way as

a direct debit. You authorise a company

to take regular payments - say,

for an annual subscription or service -

from your credit card. Simple,

easy, convenient... until you want to

cancel it.

Unlike a direct debit, a recurring

payment does not

automatically

cease to exist when you close your

account down. You cannot even cancel

it by notifying your credit card

provider that you want it to stop. The

only way to cancel a recurring payment

is to ask the original merchant

you set it up with to stop taking the

payments.

A dangerous system

As if that wasn't enough, there are two

big dangers

associated with this method of payment:

- You and you alone are responsible for

keeping a

record of all the

recurring payments you have set up on your

card. The credit card

provider will not keep track of them. And

if you don't know which

companies are authorised to take recurring

payments from your card,

then you will not be able to cancel the

payments.

- If you cancel the account and then, say,

move house,

your statement

will go to your old address. So you will

have no way of knowing that a

new payment has been taken from your card,

and that you need to pay it

off. This could lead to a black mark being

placed on your credit

record, which could cause you serious

problems if you try to take out a

new card or borrow a mortgage

in the future.

So if you're

ever faced with

the option of making a

regular payment

by credit card or direct debit, my advice

would be to choose the direct

debit route every time.

Too late

If this advice

comes a little

too late for you - as it

did for one

lovemoney.com reader, Neil D. - then what

can you do about it?

Neil wrote in to

lovemoney.com because, six months after

cancelling

an MBNA credit card, he received a statement

stating that more than

£90

had been paid from the card to a car

breakdown company. This was for

cover he no longer needed or wanted.

What to do

What should you

do if you

find yourself in this

situation?

1. Dispute the

payment with

the company that took it.

Believe it or

not, you are

much more likely to get a

refund this way

than arguing with the credit card company

that you closed the account

or weren't aware that the payment would

recur. Here's how to argue your

case:

- A reputable company will send you a

letter warning

you that your

subscription is up for renewal, and that

payment will be taken on a

particular date. If you didn't receive

this letter, you have a case for

disputing the payment.

- Depending on what you have bought, you

should have a

cooling off

period of at least seven days, where you

can cancel the policy or

return the goods. Contact Consumer

Direct

to double-check your rights, if you find

this cooling off period is

disputed. You may even have longer than

seven days.

- Finally, try explaining your situation

calmly and

reasonably. For

example, Neil, our 66-year-old reader, no

longer drives a car and

therefore has no need for car breakdown

cover. Clearly, he would not

have renewed this cover voluntarily. Most

reputable companies will take

a reasonable attitude when there is a

clear case for a refund like

this. If they don't, you could try

reporting them to a relevant

regulator or trade body.

2.

Dispute the payment

with the credit card

provider.

If you fail to

get a refund

from the company that took

the payment,

it's still worth at least trying to get a

refund from the credit card

provider - although it may be difficult.

- If you have cancelled your card, you

could argue that

you hadn't

realised that the payment would be taken.

This is especially true if it

is obvious, as in Neil's case, that you

would never have knowingly

renewed the subscription or service.

- Alternatively, do bear in mind you have

Section

75

Protection

for payments over £100. So if the product

cost more than

£100 and was

misrepresented to you in any way, you

could dispute the payment on

these grounds.

Using these

arguments, I am

pleased to say Neil

successfully managed

to get his payment refunded - but only after

Citizens Advice got

involved.

Many of you with

recurring

payments on your cards may

not be so lucky. So watch out for this nasty

little credit

card sting - and stick to direct

debits whenever you can!

OUTSOURCING

IS A

DEVASTATING

CAUSE OF

RECESSION IN

BRITAIN OUTSOURCING

IS A

DEVASTATING

CAUSE OF

RECESSION IN

BRITAIN

Recently

Birmingham City Council announced

that they were going to outsource

to

India. Are these idiots really

serious? Instead of promoting

local jobs

they are depriving Birmingham of

money. Firstly those being made

redundant go on Jobseekers

allowance and maybe Housing

Benefits and

Council Tax Benefits. Then the

local shops and services lose out

as

there is less spending power. All

round they create more recession.

This has got to stop- we suggest

that where British Companies

servicing

British people in Britain

outsource outside Europe then the

fees paid

for that outsourcing should be

exempt from being accepted as a

trading

cost and disallowed to be shown as

such in their accounts. If you

know

of companies doing this let us

know and we shall shame them and

others

can avoid using them. Recently

Birmingham City Council announced

that they were going to outsource

to

India. Are these idiots really

serious? Instead of promoting

local jobs

they are depriving Birmingham of

money. Firstly those being made

redundant go on Jobseekers

allowance and maybe Housing

Benefits and

Council Tax Benefits. Then the

local shops and services lose out

as

there is less spending power. All

round they create more recession.

This has got to stop- we suggest

that where British Companies

servicing

British people in Britain

outsource outside Europe then the

fees paid

for that outsourcing should be

exempt from being accepted as a

trading

cost and disallowed to be shown as

such in their accounts. If you

know

of companies doing this let us

know and we shall shame them and

others

can avoid using them.

In the meantime your editor

has been receiving 3 to 4 calls a

day

on his Orange nobile phone from a

number shown as 0845 450 3102. It

appears to be from Gajwel,

Sangareddy, India. So far

they have

called 28 times in a week!. As a

dialling machine is calling I just

hear silemce. They can't be

blocked by TPS because they are

abroad. Even if they talked they

would not be dealt with for

reasons

stated above. Orange & EE have

been informed and Orange

subscribers

are being targeted. Mr

Osborne please tax these

activities!

Here are some organisations that

use overseas call centres:

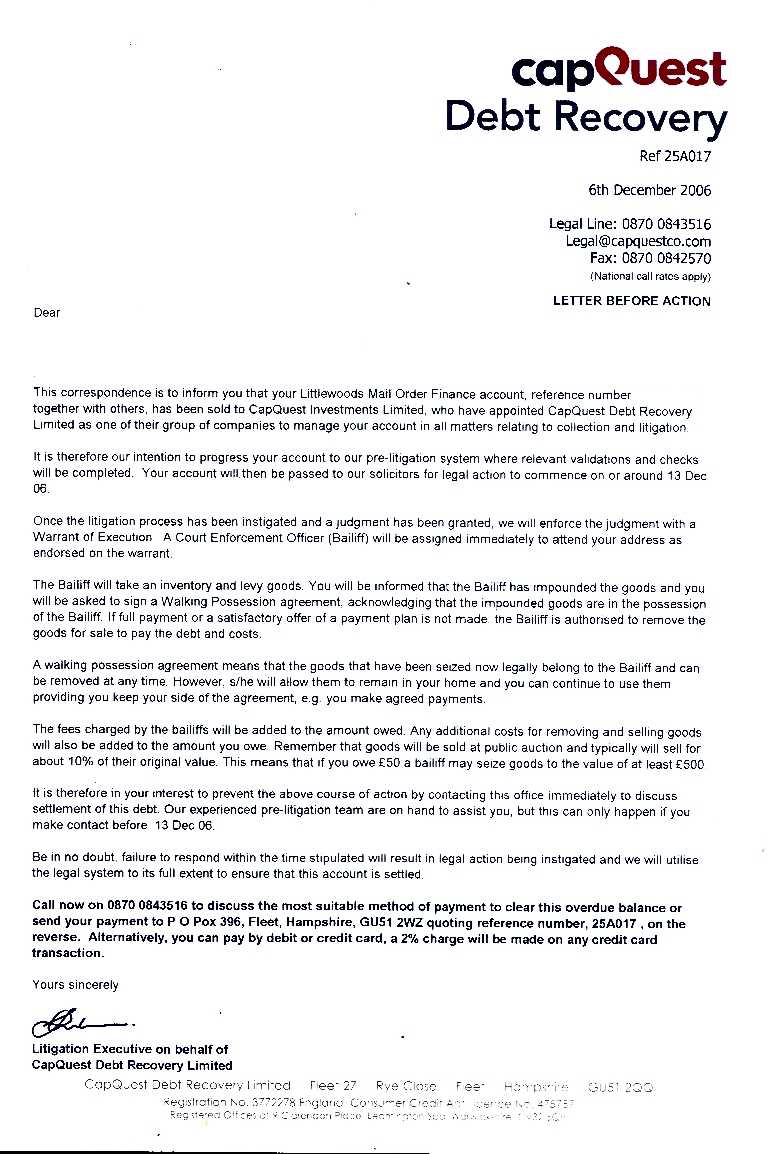

BEWARE

THE CHEQUE

SCAM OR TIT FOR TAT

by our in-house would-be

sucker

|

| Every

so often some idiot trickster tries

to con us on the internet. This one

came through our Skype connection.

Now we regularly get young ladies

from Ghana or other West African

Countries trying to "chat". After a

few minutes chatting they try to get

us to send money to them. A polite

No usually ends this. But in the

last month one of our older

directors

had a so-called young 27 year old

"lady" from Gauteng , South Africa .

She sent an email with her pictures

as shown above. One showing her

breast.She claimed that she was in

the Media Pr business and worked in

the field of beauty products. She

also said that she was hoping to

visit England on behalf of her

company, for whom she had worked for

6

months, within the near

future, if selected. Well the next

week

she went for an interview and , lo

& behold, she got picked. On

the

day of selection she contacted our

would be sucker and told him the

good news. |

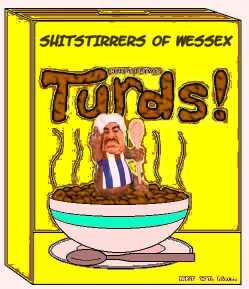

She

would be coming a week later. But

there was one problem. She had to

have money sent to England by her

Company, whose headquarters were in

Germany. Could our would-be sucker

receive it for her. By now we knew a

scam was coming. So we gave a

dormant account name with 1p in it!

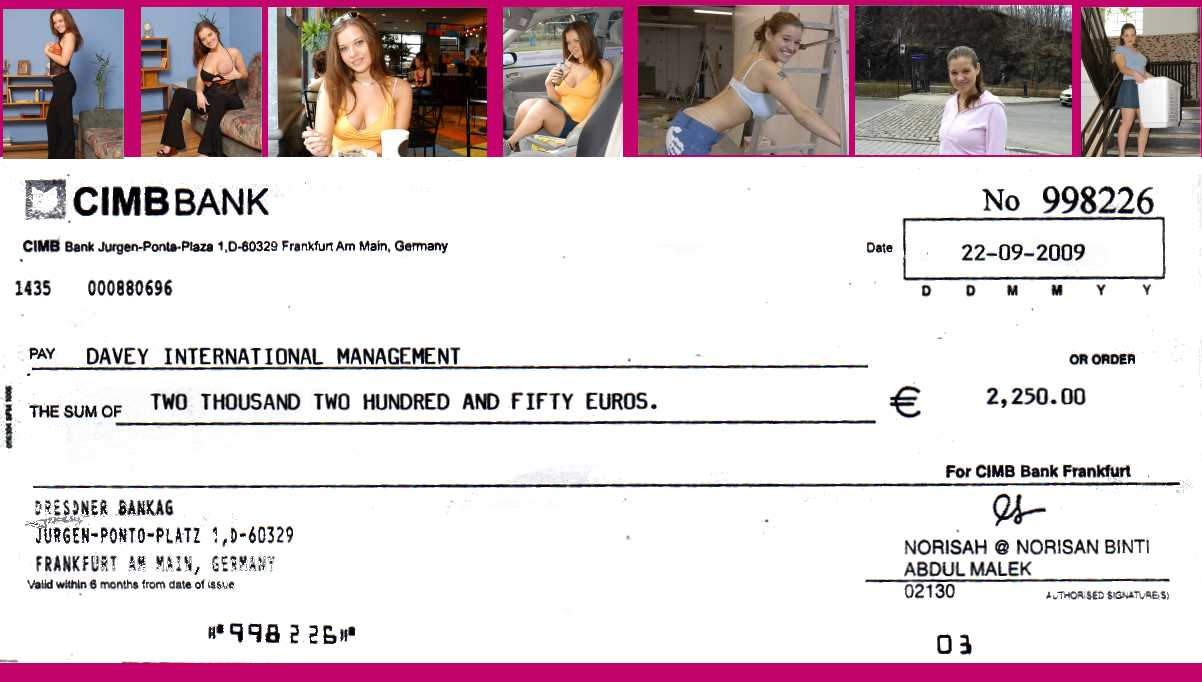

2

days later an envelope addressed to

thecompany, posted special

delivery, arrived. It

was, as shown above, in

Euros in the sum of 2,250 Euros. |

On the day of arrival it was banked

& the bank stated that there

could be up to 5 weeks to clear the

cheque as it was in a foreign

currency. So we sent a copy to the

Connerz bank which now owns the

CIMBBANK. Well the weekend passed

and on Monday Miss Robinson said she

was to come the following Thursday

and could our would-be sucker

advance her the £720 for her air

ticket! This is when the

scam was confirmed as she said we

should take it out of the proceeds

of

the cheque when it was cleared. We

already knew it would never clear.

So we asked her to get her travel

agent to contact us.He never did.

The

details of Miss Robinson are below.

It could have been an expensive

view of a tit!

|

| Email:

Sharon Robinson sharon.robinson871@gmail.com.

|

Phone

No +27833665908. |

Skype

No:Shally 435 |

|

Liberty

is

"when some perfectly

respectable person gets up and

says something everybody

agrees to, "

while "license is when some

infernal scoundrel, who ought

to be hanged

anyway, gets up and says

something that is true."

Liberty

is

"when some perfectly

respectable person gets up and

says something everybody

agrees to, "

while "license is when some

infernal scoundrel, who ought

to be hanged

anyway, gets up and says

something that is true."

So

it

was John Wilkes—radical

journalist, member of

Parliament, outlaw, prisoner, lord

mayor of London, and

self-described

libertine in the 18th century. His

life and career go a long way

toward dispelling the superstition

that liberty must advance hand in

glove with order, guided by men of

sterling moral character. Probably

born in 1726 (the exact year is

uncertain), Wilkes clashed with

George

III

and his ministers . In

John

Wilkes, his

new

biography, Arthur H. Cash shows

us why lovers of

liberty, at least, should

celebrate this colourful

Englishman. Cash

tells his readers from the outset,

"If you think the police have the

right to arrest forty-nine people

when they are looking for three,

shut

[this book] now."

With

this in

mind Shitstirrers

read this

notice from the Arthur Daley's

down at the Winchester Club to

ourselves

amongst others and realised that

so-called

"freedom of speech" and action is

once more being challenged. So

much

in the spirit of John Wilkes's No

45 The North Briton we are hereby

challenging the Winchester Club in

their authority to try and

curb freedom of speech . We

have

informed them and their Chairman

of our

actions and will publish any

response or legal action that

ensues.

At

present we just publish their

letter and our response.

The relevant Members of

Parliament in

Hampshire are

who invited to look into

this are: Aldershot

Gerald

Howarth (Con), Basingstoke

Andrew

Hunter (Con), East

Hampshire

Michael Mates (Con), Eastleigh

David

Chidgey (LDem), Fareham

Mark

Hoban (Con), Gosport

Peter

Viggers (Con), Havant

David

Willetts (Con), New

Forest East

Dr Julian Lewis (Con), New Forest

West

Desmond Swayne (Con), North

East Hampshire

Rt Hon James Arbuthnot (Con), North West

Hampshire

Rt

Hon Sir George Young Bt (Con), Portsmouth

North

Syd Rapson BEM (Lab), Portsmouth

South

Mike Hancock CBE (LDem), Romsey

Sandra

Gidley (LDem), Southampton

Itchen

Rt Hon John Denham (Lab), Southampton,

Test

Dr Alan Whitehead (Lab) and Winchester

Mark

Oaten (LDem). Every Local

Councillor in Hampshire

should

question such action too.

From

The

Winchester Club

Our

Response

Email:

drummondco@drummondco.idps.co.uk

Website: www.ukinformedinvestor.co.uk

A.Havlin

Esq.

Legal Practice,Chief

Executive’s Department

The Castle

WINCHESTER

Hampshire

SO23 8UJ

Thursday, 20 November

2008

Ref:

CL54080AH

Dear Mr.

Havlin

YOUR

NOTICE

We thank

you for your posted

Notice received today

We still do

not comprehend your

blanket

notice as most of the

sites you mention have

no mention or reference

or

carry

any images in regards to

Hampshire County Council

whatsoever. Please

inform us

of any specific image or

information that you

consider unlawful. As

the

sites www.ukinformedinvestor.co.uk,

www.wessextouristboard.co.uk and www.mercia.me.uk

carry no mention of

Hampshire or show any

images of Hampshire

other

than one of

many 1000s of click

throughs to websites I

cannot understand any

relevance in

this matter other than

to intimidate.

In fact

the only page on all

our sites that made any

reference to

the Hampshire County

Council is www.wessex.me.uk/HampshireAttractions.html We,

shall comply with your

notice in regards

anything you

specifically request to

be changed or removed on

that page

as a

courtesy, even though we

did enquire in regards

to this in 2003 before

it was

written and we

acknowledge your

assistance. The site was

www.chardnet.co.uk

at that time. So

please identify that

which you consider is

your intellectual

property

and we

will re-write and /or

replace images. We await

your further &

better

particulars on the

relevant sites and then

we will comply within 14

days on any

proven breach of

intellectual property

However

we

are quite

prepared to accept legal

proceedings and get a

legal decision on the

other

matters, which we

believe have no legal

standings whatsoever. We

have

placed

the following on the

page mentioned above as

follows:

“This

section has been a

feature of this part

of Wessex

since it was written 4/5

years ago ( when our

site was

www.chardnet.co.uk).

Unfortunately the

Hampshire County Council

has issued a NOTICE

TO

CEASE

& DESIST IN USING

AND/OR HYPERLINKING TO

HAMPSHIRE COUNTY

COUNCIL'S

TOURIST

INFORMATION AND IMAGES

ONTO/OR BY THIS SITE and

others &

tried to

influence 3rd parties.

They claim that

unspecified parts are

their

"intellectual "property

& must be removed.

But have failed to

specify which parts. It

is our intention to

continue

to

show

this search engine to

assist visitors and

defend our right of free

speech. We have, until

now, published an

acknowledgement to

Hampshire County Council

just here and referred

people to

their site. This it

seems has created

offence as have our

other sites,

which

have been specified,

which are financial,

legal and commercial and

have

never

shown anything

pertaining to Hampshire

County Council. Our

sites have

been

on-line since 1999 and

date back through other

means of media to 1972.

These

thumbnails are a means

of direction to the

various websites and are

not

a copy

of "War & Peace"

lifted from Tolstoy! No

charges have ever been

levied for our

information services. We

shall be publishing the

correspondence

for readers to judge on

our Shitstirrers of

Wessex page and the UK

Informed

Investor will now be

mentioning it on their

Watchdog page. It shall

also be

brought to the notice of

people of influence. We

always name names.

Details of

our breach(es) of

"Intellectual" Property

"MAY BE"

available from

the Tony Havlin, Jeff

Pattison and Andrew

Smith at The Castle

Winchester, Hampshire

SO23 8UJ.

Tel:01962 841841. Fax:

01962 840215 Email: Tony.havlin@hants.gov.uk.

Once

identified they will

be replaced by this

notice as requested

and all

the

thumbnails will be

rounded off. We

apologise to the

attraction owners

if this

means they have fewer

visitors as over 35

million page visits to

our

sites have been

made, and over 25

million in 2008 so

far. The

domain

names of

www.wessex.me.uk and

www.wessextouristboard.org.uk

have been

properly

registered. There is

no legal definition of

the words "Tourist

Board"

or prohibition for the

use of such

titles or a law

to prohibit

hyper-linking from the

site as they have

tried to intimate. If

so we

note they

are listed on many

other search engines

with hyper-links.

Maybe the

Government

will stop the

"Ministry of Sound"

nightclub or the

"Ministry of

Cakes" in Taunton,

Somerset.

We

also

point out that we have

complied with The

Consumer

Protection (Distance

Selling) Regulations by

placing the “contact us”

hyperlink

on each page and that

hyperlink goes to the

page where the details

are

lodged.

As for

the name Wessex Tourist

Board. This has been

properly

registered and accepted.

We shall not desist from

using the name unless

so

ordered by a Court of

Law. Please advise us of

any legislation that you

believe

enhances your telling us

to desist from using

that name.

We have for many

years now been

assisting

readers both by email

and on the telephone

with information in

regards

to

Tourism in both Wessex

and Mercia. Especially

when local tourist

offices are

closed on Saturday

afternoons and Sundays.

This has been done free

of

charge

and courteously. We

fail

to see what

this has to do with the

Hampshire County

Council. As we do not

charge

the

matter of fees is

immaterial. We are a

firm of European Tax and

Legal

advisers

who have created

reference pages as a

service and it is in the

fields

of legal

and tax advice that we

have charged since 1966.

The fees are dependant

on the

advice we give and the

work done.

Interference

with

us carrying on our

legitimate business , if

this

continues, will be

counterclaimed if you

continue to proceed with

legal

action.

It

has

always been our

intention to work in

harmony and

co-operation and a

simple call or request

in the first instance

would

have been

dealt with to everyone’s

satisfaction. You made

no such approach . We

are still

open to constructive

discussion. We do

reserve the right to

publish the

correspondence on our

sites for the

consideration of our

readers, as we

always

do whether it be with

large corporations,

local councils,

Insurance

Companies,

Government Offices or

the public. We have a

“Watchdog Column” on our

financial

site, which is usually

picked up by the media.

Assuring

you

of our

services at all times.

Faithfully

yours,

Drummond

&

Co.

|

The Wessex Tourist

Board Kiosks will be

opening at Easter 2009

in conjunction with a

major Hotel Group. They

will be open 7 days a

week 9am-9pm and will

include services to

visitors never before

available from Tourist

Offices. There will be

three in Hampshire!

|

|

|

CEO

E-mail addresses

So,

you're

fed up dealing with "Customer Services"

on

general-purpose contact e-mail

addresses. Are you not getting replies,

or not getting the replies you want?

Time to take it to the top! Chief

Executive Officers (CEOs) are very

reluctant to publish their e-mail

addresses. This page attempts to redress

the balance by publishing the

e-mail addresses for the CEOs of some UK

companies, government and

other organisations. We believe in

letting the "little people" get

noticed. It seems that this column

has upset some people. We

believe

in transparency and publishing what is

already in the public domain.

two Companies have complained to our

providers that we list

them...

they are Dreams The bed Company &

Hillary's the Blind people.

Whilst we hve had dealings with Dreams

and may well be publishing a

case of alleged unfair dismissal of a

member of staff which is going

before a tribunal, we have had no

dealings with Hillarys. we have also

been approached by a company who

represent directline-the Insurance

people. Their reason is concerns about

Google's policy of demoting a

company that have too many

listings. Whilst we appreciate the

sentiments this is nothing more than a

restrictive practice within the

advertising industry...which is

illegal. Most of those listed

have

websites, advertise and tout for

business. Our information is gleaned

from those sources as well as public

listings. They aretherefore in the

public domain.

Obviously some people have had a go at

the providers of the list

Ceomail as they have written to ask us

to remove this section.

THIS WE

WILL NOT DO.... the public have the

right to avail themselves of such

information... so we are going to

extend create our own extensive

list

and mention those companies we have had

complaints about. In fairness

we shall commend those companies or

institutions who have acted

properly and rectified problems. Amongst

those wecommend are BT, Talk

talk, Vodafone, Orange(EE) and Plusnet.

Also David Laws MP, Jeremy

Browne MP , Grant ShappsMP and Oliver

Letwin MP. We thank Ceomail for

their assistance in the past.

Some tips when e-mailing:

- Be polite

- Keep the information concise and

to the point

- Include customer reference

numbers or invoice

numbers,

if applicable

- Include a brief history of the

issue, if

applicable

- Do not accept being passed back

to "Customer

Services"

or elsewhere within the organisation

- Insist on a reply from the CEO

If you're working as part of a campaign

group, send

a personal, individually-created letter.

Letters which are cut/pasted

from

a standard template will invariably receive a

standard template

response

in reply... Good luck with your enquiry!

|

Contact

your Councillors, MP,

MEPs,

MSPs,

or Northern

Ireland, Welsh and London AMs

for free

Do you need help

with

your

postcode?

|

UK

Companies

| Company Name |

CEO Name |

CEO E-mail Address |

Website |

FTSE Symbol |

Last Verified |

| Agro-Food

&

Drinks |

|

|

|

|

|

| Associated British

Foods |

George Weston, Chief

Executive |

georgeweston@abfoods.com |

http://www.abf.co.uk |

ABF.L

(FTSE100) |

16 Jun 2010 |

| Cadbury-Schweppes |

Todd Stitzer, Chief

Executive |

Todd.Stitzer@csplc.com |

http://www.cadburyschweppes.com |

CBRY.L

(FTSE100) |

16 Jun 2010 |

| Dairy Crest |

Mark Allen, Chief

Executive |

mark.allen@dairycrest.co.uk |

http://www.dairycrest.co.uk |

DCG.L

(FTSE250) |

16 Jun 2010 |

| Diageo |

Paul

Walsh, Chief Executive |

paul.s.walsh@diageo.com |

http://www.diageo.com |

DGE.L

(FTSE100) |

16 Jun 2010 |

| Dominos UK |

Chris Moore, Chief

Executive |

chris.moore@dominos.co.uk |

http://www.dominos.co.uk

Tel: 01908 580604 |

|

21 Sep 2010 |

| Fyffes |

David McCann,

Chairman |

dmccann@fyffes.com |

http://www.fyffes.com |

(Ireland) |

16 Jun 2010 |

| Kelloggs UK |

Greg Peterson,

Managing Director,

UK |

greg.peterson@kellogg.com |

http://www.kelloggs.co.uk |

|

16 Jun 2010 |

| KFC UK |

Martin Shuker,

Managing Director |

martin.shuker@yum.com |

http://www.kfc.co.uk |

Part of Yum! Brands |

16 Jun 2010 |

| McDonalds UK |

Steve Easterbrook,

Chief Executive |

steve.easterbrook@uk.mcd.com |

http://www.mcdonalds.co.uk |

|

16 Jun 2010 |

| Pizza Express UK |

Mark Angela,

Managing Director |

mark.angela@pizzaexpress.com |

http://www.pizzaexpress.com |

|

16 Jun 2010 |

| Pizza Hut UK |

Jens Hofma, Managing

Director |

jens.hofma@pizzahut.co.uk |

http://www.pizzahut.co.uk |

Part of Yum! Brands |

16 Jun 2010 |

| Unilever |

Paul Polman, Chief

Executive |

Paul.Polman@unilever.com |

http://www.unilever.com |

ULVR.L

(FTSE100) |

16 Jun 2010 |

| Whitbread

(Beefeater, Brewers

Fayre, Costa, Premier Inn) |

Andy Harrison, Chief

Executive |

andy.harrison@whitbread.com |

http://www.whitbread.co.uk/ |

WTB.L |

1 Sep 2010 |

| Automobiles |

|

|

|

|

|

| Audi UK |

Jeremy Hicks,

Director |

jeremy.hicks@audi.co.uk |

http://www.audi.co.uk |

|

16 Jun 2010 |

| Bentley UK |

Franz-Josef Paefgen,

Director |

franz-josef.paefgen@bentley.co.uk |

http://www.bentley.co.uk |

|

16 Jun 2010 |

| BMW UK |

Tim Abbott, Managing

Director |

tim.abbott@bmw.co.uk |

http://www.bmw.co.uk |

|

16 Jun 2010 |

| Ford UK |

Nigel Sharp,

Managing Director |

nsharp@ford.com |

http://www.ford.co.uk |

|

16 Jun 2010 |

| Honda UK |

Ken Keir, Managing

Director |

ken.keir@honda.co.uk |

http://www.honda.co.uk |

|

3 Sep 2010 |

| Jaguar Land Rover |

Carl-Peter Forster,

Chief

Executive |

pforster@jaguarlandrover.com |

|

Part of Tata Motors |

28 May 2010 |

| Land Rover |

Phil Popham,

Managing Director |

ppopham@jaguarlandrover.com |

|

Part of JLR / Tata

Motors |

28 May 2010 |

| Manganese Bronze

(Taxis) |

John Russell, Group

Chief

Executive |

jrussell@manganese.com |

http://www.manganese.com |

|

28 Jun 2010 |

| Mercedes-Benz UK |

Simon Oldfield,

Managing Director

Customer Services |

simon.oldfield@daimler.com |

http://www.mercedes-benz.co.uk/ |

|

6 Aug 2010 |

| Mitsubishi UK |

Lance Bradley,

Managing Director |

l.bradley@mitsubishi-cars.co.uk |

http://www.mitsubishi-cars.co.uk |

|

21 Jul 2010 |

| Nissan UK |

Paul Willcox,

Managing Director |

paul.willcox@nissan.co.uk |

http://www.nissan.co.uk |

|

29 Mar 2010 |

| Peugeot UK |

Jonathan Goodman,

Managing

Director |

jonathan.goodman@peugeot.com |

http://www.peugeot.co.uk |

|

8 Jun 2010 |

| Porsche GB |

Andy Goss, Managing

Director |

andy.goss@porsche.co.uk |

http://www.porsche.co.uk |

|

29 Mar 2010 |

| Renault UK |

Roland Bouchaea,

Managing Director |

roland.bouchara@renault.com |

http://www.renault.co.uk |

|

14 Sep 2010 |

| Rolls-Royce Motor

Cars |

Torsten

Müller-Ötvös, Chief Executive |

|

http://www.rolls-roycemotorcars.com |

Part of BMW |

3 Mar 2010 |

| Toyota UK |

Miguel Fonseca,

Managing Director |

miguel.fonseca@tgb.toyota.co.uk |

http://www.toyota.co.uk |

|

21 Feb 2010 |

| Vauxhall / Opel UK |

Nick Reilly, Chief

Executive |

nick.reilly@gm.com |

http://www.vauxhall.co.uk |

|

9 Feb 2010 |

| Volkswagen UK |

Chris Craft,

Director |

chris.craft@volkswagen.co.uk |

http://www.volkswagen.co.uk |

|

29 Mar 2010 |

| Volvo UK |

Peter Rask, Managing

Director |

prask@volvocars.com |

http://www.volvocars.com/uk |

Part of Zhejiang

Geely Holding

Group |

3 Apr 2010 |

| Charities

|

|

|

|

|

|

| Arts Council |

Alan Davey, Chief

Executive |

alan.davey@artscouncil.org.uk |

|

|

26 Sep 2010 |

| Barnardo's |

Martin Narey, Chief

Executive |

martin.narey@barnardos.org.uk |

|

|

26 Sep 2010 |

| British Heart

Foundation |

Peter Hollins, Chief

Executive |

hollinsp@bhf.org.uk |

|

|

26 Sep 2010 |

| Cancer Research UK |

|

|

|

|

26 Sep 2010 |

| National Trust |

|

|

|

|

26 Sep 2010 |

| Oxfam |

Barbara Stocking,

Chief Executive |

bstocking@oxfam.org.uk |

|

|

26 Sep 2010 |

| RSPB |

Graham Wynne, Chief

Executive |

graham.wynne@rspb.org.uk |

|

|

26 Sep 2010 |

| RSPCA |

Mark Watts, Chief

Executive |

mwatts@rspca.org.uk |

|

|

26 Sep 2010 |

| Salvation Army |

|

|

|

|

26 Sep 2010 |

| Scope |

Richard Hawkes,

Chief Executive |

richard.hawkes@scope.org.uk |

|

|

26 Sep 2010 |

| Wellcome Trust |

|

|

|

|

26 Sep 2010 |

| Chemicals |

|

|

|

|

|

| BOC Group |

Mike Huggon,

Managing Director |

janet.sheldrick@boc.com

(PA) |

http://www.boc.com |

Part of the Linde

Group |

3 Mar 2010 |

| ICI |

John McAdam, Chief

Executive |

john_mcadam@ici.co.uk |

http://www.ici.co.uk |

ICI.L

(FTSE100) |

|

| Reckitt Benckiser |

Bart Becht, Chief

Executive |

|

http://www.rb.com |

RB.L

(FTSE100) |

4 Jan 2010 |

| Construction &

Building |

|

|

|

|

|

| Balfour Beatty |

Ian Tyler, Chief

Executive |

ian.tyler@balfourbeatty.com |

http://www.balfourbeatty.com |

|

16 Sep 2010 |

| EAGA Insulation |

Drew Johnson, Chief

Executive |

drew.johnson@eaga.com |

http://www.eaga.com |

|

21 Aug 2010 |

| Travis Perkins

(Wickes,

Toolstation, Tile Giant, Benchmarx) |

Geoff Cooper, Chief

Executive |

geoff.cooper@travisperkins.co.uk |

http://www.travisperkins.co.uk |

|

24 Sep 2010 |

| Wain Homes |

Steve Toghill, Chief

Executive |

steve.toghill@wainhomes.net |

http://www.wainhomes.net |

|

21 Aug 2010 |

| Distribution |

|

|

|

|

|

| Alliance Boots |

Andy Hornby, Chief

Executive |

andy.hornby@allianceboots.com |

http://www.allianceboots.com |

Privately held |

17 May 2010 |

| Arcadia Group

(Burton, Dorothy

Perkins, Evans, Miss Selfridge,

Topman, Topshop, Wallis) |

Ian Grabiner, Chief

Executive |

ian.grabiner@arcadiagroup.co.uk |

http://www.arcadiagroup.co.uk |

|

21 Feb 2010 |

| Argos |

Sara Weller,

Managing Director |

sara.weller@argos.co.uk |

http://www.argos.co.uk |

Part of Home Retail

Group |

24 Jan 2010 |

| ASDA |

Andy Clarke, Chief

Executive |

andy.clarke@asda.co.uk |

http://www.asda.co.uk |

Part of Wal-Mart |

21 May 2010 |

| Boots |

Stefano Pessina,

Executive

Chairman |

stefano.pessina@allianceboots.com |

http://www.allianceboots.com |

Part of Alliance

Boots |

|

| Burberry Group |

Angela Ahrendts,

Chief Executive |

angela.ahrendts@burberry.com |

http://www.burberry.com |

BRBY.L

(FTSE100) |

21 Feb 2010 |

| Co-operative

Group

(Co-op) |

Peter Marks, Chief

Executive |

peter.marks@co-operative.coop |

http://www.co-operative.coop |

Mutual |

2 Dec 2009 |

| Comet |

Hugh Harvey,

Managing Director |

hugh.harvey@comet.co.uk |

http://www.comet.co.uk |

Part of KESA

Electricals Group |

30 Mar 2010 |

| Damart |

Andy Hill, Chief

Executive |

ahill@damart.co.uk |

http://www.damart.co.uk/ |

|

16 Sep 2010 |

| Debenhams |

Rob Templeman, Chief

Executive |

rob.templeman@debenhams.com |

http://www.debenhams.com |

DEB.L (FTSE250) |

21 Feb 2010 |

| Dreams Beds |

Nick Worthington,

Chief Executive |

nickworthington@dreams.co.uk |

http://www.dreams.co.uk |

|

21 Aug 2010 |

| Dixons Group /

Currys / PC World |

John Browett, Chief

Executive |

john.browett@dixons.co.uk |

http://www.dixons.co.uk |

DXNS.L |

28 Oct 2009 |

| Flying Flowers |

Stephen Cook, Chief

Executive |

scook@flyingbrands.com |

http://www.flyingflowers.co.uk |

|

30 Oct 2009 |

| Freeman Grattan

Holdings

(includes Freemans, Grattan &

Lookagain) |

Koert Tulleners,

Chief Executive |

koert.tulleners@fgh-uk.com |

|

|

13 Apr 2010 |

| GAME Group PLC |

Lisa Morgan, Chief

Executive |

lisa.morgan@game.co.uk |

http://www.gamegroup.plc.uk/ |

|

7 Feb 2010 |

| Glen Dimplex

(Belling, Burco,

Carmen, Creda, Dimplex, Goblin, LEC,

Morphy Richards, Xpelair) |

Sean O'Driscoll,

Chief Executive |

sean.odriscoll@glendimplex.com |

http://www.glendimplex.com |

|

24 Mar 2010 |

| Greggs |

Ken McMeikan, Chief

Executive |

ken.mcmeikan@greggs.co.uk

|

http://www.greggs.co.uk |

GRG.L

(FTSE250) |

10 Feb 2010 |

| Halfords |

David Wild, Chief

Executive |

david.wild@halfords.co.uk |

http://www.halfords.co.uk |

|

25 Jan 2010 |

| Hillarys Blinds |

John Risman, Chief

Executive |

john.risman@hillarys.co.uk |

http://www.hillarys.co.uk |

|

19 Sep 2010 |

| Home Retail Group

(Argos and

Homebase) |

Terry Duddy, Chief

Executive |

terry.duddy@homeretailgroup.com

|

http://www.homeretailgroup.com |

HOME.L

(FTSE100) |

23 Feb 2010 |

| Homebase |

|

|

http://www.homebase.co.uk |

Part of Home Retail

Group |

10 Feb 2010 |

| House of Fraser |

John King, Chief

Executive |

jking@hof.co.uk |

http://www.houseoffraser.co.uk/ |

|

16 Sep 2010 |

| Iceland |

Malcolm Walker,

Chief Executive |

malcolm.walker@iceland.co.uk |

http://www.iceland.co.uk |

Part of Baugur |

|

| JD Sports |

Barry Bown, Chief

Executive |

barry.bown@jdplc.com |

http://www.jdsports.co.uk |

|

8 Jun 2010 |

| Jessops |

Trevor Moore, Chief

Executive |

tmoore@jessops.com |

http://www.jessops.com |

|

22 Sep 2010 |

| JJB Sports |

Keith Jones, Chief

Executive |

kjones@jjbsports.com |

http://www.jjbsports.com |

|

23 Mar 2010 |

| John Lewis

Partnership |

Andy Street, Chief

Executive |

andy_street@johnlewis.co.uk |

http://www.johnlewis.co.uk |

|

17 May 2010 |

| Kingfisher (B&Q

and Screwfix) |

Ian Cheshire, Chief

Executive |

ian.cheshire@kingfisher.com |

|

KGF.L |

25 Mar 2010 |

| Kwik-Fit |

Ian Fraser, Chief

Executive |

ian.fraser@kwik-fit.com |

http://www.kwik-fit.com |

|

9 Apr 2010 |

| Laura Ashley |

Lillian Tan, Chief

Executive |

lillian.tan@lauraashley.com |

http://www.lauraashley.com |

|

21 Feb 2010 |

| Marks & Spencer |

Marc Bolland, Chief

Executive |

marc.bolland@marks-and-spencer.com |

http://www.marksandspencer.com |

MKS.L

(FTSE100) |

11 Aug 2010 |

| Morphy Richards |

Phil Green, Chief

Executive |

phil.green@morphyrichards.co.uk |

http://www.morphyrichards.co.uk |

part of Glen Dimplex |

24 Mar 2010 |

| Morrisons |

Dalton Philips, CEO |

dalton.philips@morrisonsplc.co.uk |

http://www.morrisons.co.uk |

MRW.L

(FTSE100) |

24 May 2010 |

| Mothercare |

Ben Gordon, Managing

Director |

ben.gordon@mothercare.co.uk |

http://www.mothercare.com |

|

30 Mar 2010 |

| Next |

Simon Wolfson, Chief

Executive |

simon.wolfson@nextplc.co.uk |

|

NXL.L (FTSE100) |

29 May 2010 |

| Ocado |

Tim Steiner, Chief

Executive |

Tim.steiner@ocado.com |

http://www.ocado.com |

Partly owned by John

Lewis

Partnership |

3 Sep 2009 |

| Paperchase |

Timothy

Elliot-Murray-Kynynmound |

timothy@paperchase.co.uk |

http://www.paperchase.co.uk |

|

11 Feb 2010 |

| Peter Jones |

Simon Fowler,

Managing Director |

simon_fowler@johnlewis.co.uk |

|

Part of John Lewis

Partnership |

26 Mar 2010 |

| play.com |

John Perkins, Chief

Executive |

john.perkins@play.com |

http://www.play.com |

|

3 Jun 2010 |

| Sainsbury |

Justin King, Chief

Executive |

justin.king@sainsburys.co.uk |

http://www.sainsbury.co.uk |

SBRY.L

(FTSE100) |

3 Sep 2009 |

| Shop Direct (Empire

Stores, Great

Universal, Kays, Littlewoods, Very,

Marshall Ward, Woolworths) |

Mark Newton-Jones,

Chief Executive |

mark.newton-jones@shopdirect.com |

http://www.shopdirect.com |

|

8 Jun 2010 |

| Somerfield |

|

|

http://www.somerfield.co.uk |

Part of Co-operative

Group |

10 Dec 2009 |

| Specsavers |

John Perkins, Chief

Executive |

dougp@uk.specsavers.com |

http://www.specsavers.co.uk |

|

14 Sep 2010 |

| Sports Direct |

Dave Forsey, Chief

Executive |

Dave.Forsey@sportsdirect.com |

http://www.sportsdirect.com |

|

22 Apr 2010 |

| Staples |

Peter Birks, VP UK

& Ireland |

peter.birks@staples.co.uk |

http://www.staples.co.uk |

|

24 Jan 2010 |

| Steinhoff Group /

Homestyle /

Harveys / Benson for Beds /

Sleepmaster / Cargo |

Markus Jooste, Chief

Executive |

markus.jooste@steinhoff.co.za |

http://www.sukf.co.uk |

|

14 Sep 2010 |

| Tesco |

Terry Leahy, Chief

Executive |

terry.leahy@uk.tesco.com |

http://www.tesco.com |

TSCO.L

(FTSE100) |

27 Nov 2009 |

| Thorntons |

Mike Davies, Chief

Executive |

mike.davies@thorntons.co.uk |

http://www.thorntons.co.uk |

|

5 Feb 2009 |

| Toolstation |

Mark Goddard-Watts,

Chief

Executive |

mark@toolstation.com |

http://www.toolstation.com |

|

21 Aug 2010 |

| Waitrose |

Mark Price, Managing

Director |

mark_price@waitrose.co.uk |

http://www.waitrose.co.uk |

Part of John Lewis

Partnership |

8 Oct 2009 |

| WH Smith |

Kate

Swann, Chief Executive |

kate.swann@whsmith.co.uk |

http://www.whsmith.co.uk |

|

19 Feb 2010 |

| Electrical

& Electronics |

|

|

|

|

|

|

| Canon UK |

|

|

http://www.canon.co.uk |

|

22 Sep 2010 |

| Indesit UK

(Hotpoint, Indesit,

Cannon & Creda) |

Enrico Vita, Chief

Executive |

enrico.vita@indesit.com |

http://www.indesit.co.uk |

|

16 Sep 2010 |

| LG UK |

Brian Na, President |

brian.na@lge.com |

http://www.lge.co.uk |

|

16 Sep 2010 |

| Nikon UK |

Michio Miwa,

President |

Michio.Miwa@nikon.co.uk |

http://www.nikon.co.uk |

|

22 Sep 2010 |

| Finance

and Insurance |

|

|

|

|

|

| AEGON Scottish

Equitable |

Otto Thoresen, Chief

Executive |

Otto.Thoresen@aegon.co.uk |

http://www.aegon.co.uk |

|

24 Jan 2010 |

| Alliance &

Leicester |

|

|

http://www.alliance-leicester.co.uk |

Part of Santander

Group |

10 Dec 2009 |

| American Express UK |

Raymond Joabar,

Country Manager |

raymond.joabar@aexp.com |

http://www.americanexpress.co.uk |

|

9 Aug 2010 |

| Aviva and Royal

Automobile Club

(RAC) |

Andrew Moss, Chief

Executive |

andrew_moss@aviva.com |

http://www.aviva.com |

AV.L

(FTSE100) |

21 Aug 2010 |

| AXA UK |

Nicolas

Moreau, Chief Executive |

nicolas.moreau@axa.co.uk |

|

|

18 Feb 2010 |

| Bank of England |

Mervyn King,

Governor |

mervyn.king@bankofengland.co.uk |

http://www.bankofengland.co.uk |

|

10 Feb 2010 |

| Barclaycard |

Amer Sajed, Managing

Director |

amer.sajed@barclaycard.co.uk |

http://www.barclaycard.co.uk |

|

20 Sep 2010 |

| Barclays |

John Varley, Chief

Executive |

john.varley@barclays.com |

http://www.barclays.co.uk |

BARC.L

(FTSE100) |

10 Nov 2009 |

| Bradford &

Bingley |

Richard Banks,

Managing Director |

richard.banks@bbg.co.uk |

http://www.bradford-bingley.co.uk |

Nationalised |

19 March 2010 |

| Britannia Building

Society |

|

|

|

Part of Co-Operative

Group |

10 Dec 2009 |

| Britannic |

Paul Thompson, Chief

Executive |

thompsonp@britannic.co.uk |

|

Part of Pearl Group |

|

| Callcredit

Information Group |

John McAndrew, Chief

Executive |

john.mcandrew@callcredit.co.uk |

http://www.callcredit.co.uk |

|

1 May 2010 |

| Camelot Group

(National Lottery) |

Dianne Thompson,

Chief Executive |

dianne.thompson@camelotgroup.co.uk |

http://www.camelotgroup.co.uk |

|

9 Feb 2010 |

| Clydesdale Bank |

Lynne Peacock, Chief

Executive |

Lynne.Peacock@cbonline.co.uk |

http://www.cbonline.co.uk |

Part of National

Australia Bank |

16 Dec 2009 |

| Co-operative

Financial

Services / Co-op Bank |

Neville Richardson,

Chief

Executive |

neville.richardson@cfs.coop |

http://www.co-operativebank.co.uk |

Mutual |

8 Mar 2010 |

| Deutsche Bank UK |

Colin Grassie, Chief

Executive |

colin.grassie@db.com |

http://www.db.com |

|

21 Jul 2010 |

| Egg |

Bert Pijls, Chief

Executive |

bert.pijls@citi.com |

http://www.egg.com |

Part of Citibank |

30 Mar 2010 |

| Equifax |

Sandra Lawrence, UK

General

Manager |

sandra.lawrence@equifax.com |

http://www.equifax.co.uk |

|

19 Apr 2010 |

| Esure / Sheila's

Wheels |

Peter Wood, Chief

Executive |

peter.wood@esure.com |

http://www.esure.com |

|

1 Sep 2010 |

| Experian / Credit

Expert |

Don Robert, Chief

Executive |

don.robert@uk.experian.com |

http://www.experian.co.uk

020 3042 4215 |

EXPN.L

(FTSE100) |

21 Sep 2010 |

| First Direct |

Chris Pilling, Chief

Executive |

chrispilling@firstdirect.com |

http://www.firstdirect.com |

Part of HSBC |

25 May 2010 |

| Friends Provident |

Trevor Matthews,

Chief Executive |

trevor.matthews@friendsprovident.co.uk |

http://www.friendsprovident.co.uk |

FP.L

(FTSE100) |

|

| HSBC UK |

Paul Thurston, Chief

Executive |

managingdirectoruk@hsbc.com |

http://www.hsbc.co.uk |

HSBA.L

(FTSE100) |

|

| ICICI Bank UK |

Suvek Nambiar,

Managing Director |

suvek.nambiar@icicibank.com |

http://www.icicibank.com |

|

28 May 2010 |

| ING Direct UK |

Richard Doe, Chief

Executive |

richard.doe@ingdirect.co.uk |

http://www.ingdirect.co.uk |

|

23 Sep 2010 |

| Ladbrokes |

Richard Glynn, Chief

Executive |

richard.glynn@ladbrokes.co.uk |

http://www.ladbrokes.co.uk |

|

15 Jul 2010 |

| Legal & General |

Tim Breedon, Chief

Executive |

tim.breedon@group.landg.com |

http://www.landg.com |

LGEN.L

(FTSE100) |

|

| Liverpool Victoria |

Mike Rogers, Chief

Executive |

mike.rogers@lv.com |

http://www.lv.com |

Mutual |

23 Oct 2009 |

| Lloyds TSB (includes

Halifax /

Bank of Scotland (HBOS)) |

Eric Daniels, Chief

Executive |

eric.daniels@lloydstsb.co.uk |

http://www.lloydstsb.co.uk |

LLOY.L

(FTSE100) |

2 Sep 2009 |

| Mastercard UK |

Hany Fam, General

Manager |

hany.fam@mastercard.com |

http://www.mastercard.co.uk |

|

26 Sep 2010 |

| MBNA / Bank of

America (UK) |

Ian O'Doherty, Chief

Executive |

ian.odoherty@bankofamerica.com |

|

Part of RBS Group |

5 March 2010 |

| Nationwide |

Graham Beale, Chief

Executive |

gjbeale2@nationwide.co.uk

|

http://www.nationwide.co.uk

(Tel: 01793 513 513 then say "Graham

Beale") |

Mutual |

14 Sep 2010 |

| NatWest |

|

|

|

Part of RBS

Group |

17 Feb 2010 |

| Neovia Financial

(Netbanx,

Neteller, Net+) |

Mark Mayhew, Chief

Executive |

mark.mayhew@neovia.com |

http://www.neovia.com |

|

7 Jul 2010 |

| Northern Rock |

Gary Hoffman, Chief

Executive |

gary.hoffman@northernrock.co.uk |

http://www.northernrock.co.uk |

Nationalised |

28 Oct 2009 |

| Prudential |

Tidjane Thiam, Chief

Executive |

tidjane.thiam@prudential.co.uk |

http://www.prudential.co.uk |

PRU.L

(FTSE100) |

4 Jan 2010 |

| Royal & Sun

Alliance (RSA)

and "More Than" |

Andy Haste, Chief

Executive |

andy.haste@gcc.rsagroup.com |

http://www.royalsunalliance.com |

RSA.L

(FTSE100) |

2 Sep 2010 |

| Royal

Bank of

Scotland (RBS Group) |

Stephen Hester |

Stephen.Hester@rbs.co.uk |

http://www.rbs.co.uk |

RBS.L

(FTSE100) |

8 Feb 2010 |

| Santander

Group (formerly Abbey) |

Antonio Horta-Osorio |

Antonio.Osorio@santander.co.uk |

http://www.santander.co.uk |

|

10 Dec 2009 |

| Scottish Life |

John Deane, Chief

Executive |

jdeane@scottishlife.co.uk |

http://www.scottishlife.co.uk |

|

16 Dec 2009 |

| Skipton Building

Society |

David Cutter, Chief

Executive |

david.cutter@skipton.co.uk |

http://www.skipton.co.uk |

Mutual |

2 Feb 2010 |

| Standard Chartered

Bank |

Peter Sands, Group

Chief Executive |

peter.sands@sc.com |

http://www.standardchartered.com |

STAN.L

(FTSE100) |

10 Feb 2010 |

| Standard Life |

David Nish, Chief

Executive |

david_nish@standardlife.com |

http://www.standardlife.com |

SL.L

(FTSE100) |

10 Feb 2010 |

| Student Loans

Company (SLC) |

Ed Lester, Chief

Executive |

Ed_Lester@slc.co.uk |

http://www.slc.co.uk

Tel: 0141 306 2000 |

|

6 Sep 2010 |

| Yorkshire Building

Society /

Chelsea Building Society |

Iain Cornish, Chief

Executive |

iccornish@ybs.co.uk |

http://www.ybs.co.uk |

|

17 Mar 2010 |

| Health &

Pharmaceutical |

|

|

|

|

|

| Amersham |

William Castell,

Chief Executive |

william.castell@amersham.com |

http://www.amersham.com |

|

5 Feb 2009 |

| AstraZeneca |

David Brennan, Chief

Executive |

david.brennan@astrazeneca.com |

http://www.astrazeneca.com |

AZN.L

(FTSE100) |

5 Feb 2009 |

| GlaxoSmithKline |

Andrew

Witty, Chief Executive |

andrew.witty@gsk.com |

http://www.gsk.com |

GSK.L

(FTSE100) |

18 Feb 2010 |

|

IT |

|

|

|

|

|

| ARM Holdings |

Warren East, Chief

Executive |

warren.east@arm.com |

http://www.arm.com |

ARM.L

(FTSE250) |

21 Feb 2010 |

| Autonomy |

Mike Lynch, Chief

Executive |

mlynch@autonomy.com |

http://www.autonomy.com |

AU.L

(FTSE100) |

21 Feb 2010 |

| Leisure

&

Entertainment |

|

|

|

|

|

| Carnival (formerly P

and O) |

Micky Arison,

Chairman &

Chief Executive |

marison@carnival.com |

|

CCL.L

(FTSE100) |

30 Jul 2010 |

| Football Association

(FA) Premier

League |

Richard Scudamore,

Chief Executive |

rscudamore@premierleague.com |

|

|

21 Mar 2010 |

| Silverstone Circuits |

Richard Phillips,

Chief Executive |

richard.phillips@silverstone.co.uk |

|

|

21 Aug 2010 |

| Media |

|

|

|

|

|

| B Sky B |

Jeremy Darroch,

Chief Executive |

jeremy.darroch@bskyb.com |

http://www.bskyb.com |

BSY.L

(FTSE100) |

23 Oct 2009 |

| BBC |

Mark

Thompson, Director General |

mark.thompson@bbc.co.uk |

http://www.bbc.co.uk |

N/A |

15 Feb 2010 |

| BBC Today Program |

|

today@bbc.co.uk |

http://www.bbc.co.uk/today |

N/A |

5 Feb 2010 |

| BBC Watchdog |

|

watchdog@bbc.co.uk |

http://www.bbc.co.uk/watchdog/ |

N/A |

5 Feb 2010 |

| BBC Working Lunch |

|

workinglunch@bbc.co.uk |

http://www.bbc.co.uk/workinglunch/ |

N/A |

5 Feb 2010 |

| Channel 4 |

David Abraham, Chief

Executive |

dabraham@channel4.co.uk |

http://www.channel4.co.uk |

|

15 Jul 2010 |

| Daily Telegraph |

Will

Lewis, Editor |

will.lewis@telegraph.co.uk |

http://www.telegraph.co.uk

Tel: 0207 931 2000 |

N/A |

15 Feb 2010 |

| EMAP |

David Gilbertson,

Chief Executive |

david.gilbertson@emap.com |

http://www.emap.com |

Owned by Apax and

Guardian Media

Group |

24 Nov 2009 |

| The Guardian |

Alan

Rusbridger, Editor |

alan.rusbridger@guardian.co.uk |

http://www.guardian.co.uk |

N/A |

5 Feb 2010 |

| The Independent |

Simon

Kelner, Editor |

s.kelner@independent.co.uk |

http://www.independent.co.uk

Tel: 020 7005 2000 |

N/A |

14 May 2010 |

| The Independent on

Sunday |

John Mullin, Editor |

j.mullin@independent.co.uk |

http://www.independent.co.uk |

N/A |

5 Feb 2010 |

| ITV |

Adam Crozier, Chief

Executive |

adam.crozier@itv.com |

http://www.itv.com |

|

21 May 2010 |

| PR Week |

Danny Rogers, Editor |

danny.rogers@haymarket.com |

http://www.prweek.com |

|

16 Sep 2010 |

| Reed Elsevier |

Erik Engstrom, Chief

Executive |

erik.engstrom@reedelsevier.com |

http://www.reedelsevier.com |

REL.L

(FTSE100) |

21 Feb 2010 |

| Reuters Group |

Tom Glocer, Chief

Executive |

tom.glocer@reuters.com |

http://www.reuters.com |

|

|

| The Sunday Times |

John Witherow,

Editor |

john.witherow@thetimes.co.uk |

http://www.timesonline.co.uk |